Salesforce QuickBooks Integration (A Step-by-Step Guide)

Accounting and marketing/sales are two of the core operations of any successful business, and it’s vital for companies to integrate the critical systems that support those functions.

Giving your team greater visibility and insight into the sales pipeline, the success and impact of marketing activities, and whether those efforts convert into new revenue can propel a business to greater growth and faster expansion.

That’s why many businesses want to integrate Salesforce with QuickBooks so they can equip their teams with better data and actionable insights to achieve growth goals.

As the world’s #1 customer relationship management platform, Salesforce offers extensive integration capabilities with the leading software providers across all major business functions.

QuickBooks is an easy-to-use accounting platform for small and medium-sized businesses that tracks and organizes your income and expense information for you, eliminating the need for manual entry and reducing human errors such as typos or faulty data.

Owned by parent company Intuit Inc., QuickBooks automates tasks such as bookkeeping, invoicing, time tracking, budgeting, bank reconciliation, inventory management and many other core business functions.

Salesforce QuickBooks integration can immediately benefit companies of all sizes and make teams more efficient and productive across your finance, accounting, marketing and sales departments.

This article discusses how to integrate Salesforce with QuickBooks, best practices to ensure that the two systems talk to each other, and pitfalls to avoid.

Benefits of Salesforce and QuickBooks Integration

First, let’s talk about some advantages of integrating QuickBooks and Salesforce. The platforms already offer the following benefits to their users.

Salesforce

- Salesforce is the world’s #1 CRM and it’s easy to learn, with excellent training support

- The user interface is intuitive for new users

- Salesforce offers solo training sessions through its Trailhead learning and development platform that lets people learn at their own pace

- Trailhead also lets users self-lead to take additional modules and acquire other skill sets that might be adjacent to their current role

- The per-user cost is relatively low and affordable

- Users can create customized views, displays, reports, dashboards, and other functions for a better unique experience

QuickBooks

- The #1 accounting software, used by an estimated 80% of small and medium-sized businesses

- Affordable

- Easy to deploy

- Easily accessible and integrated

- Real-time collaboration

- Cloud accounting ensures secure data back-up

- More efficient administrative operations and data entry

- More automation

Salesforce QuickBooks Integration: A Step-By-Step Guide

Salesforce QuickBooks integration is easy, but it’s essential to get it properly configured and set up to ensure data integrity and that the two systems properly talk to each other and share data back and forth.

It may also be necessary to integrate other systems such as your company’s online shopping cart or e-commerce software, fulfillment software, shipping and tracking systems, returns and exchanges software, etc.

We recommend working with an experienced and trusted Salesforce consultant and developer to integrate Salesforce and QuickBooks to make sure it happens seamlessly.

A Salesforce consultant can work in a sandbox environment and do extensive testing, data backup and other critical planning so that your business doesn’t experience any interruptions or downtime during the transition. Your QuickBooks Salesforce integration can and should happen seamlessly and instantly so your team can reap the benefits right away.

There are seven essential steps to integrating your QuickBooks financial and accounting software with your Salesforce CRM, and here is an easy step-by-step guide for how to do it.

Step 1

First, log in to your QuickBooks Online Advanced account.

Step 2

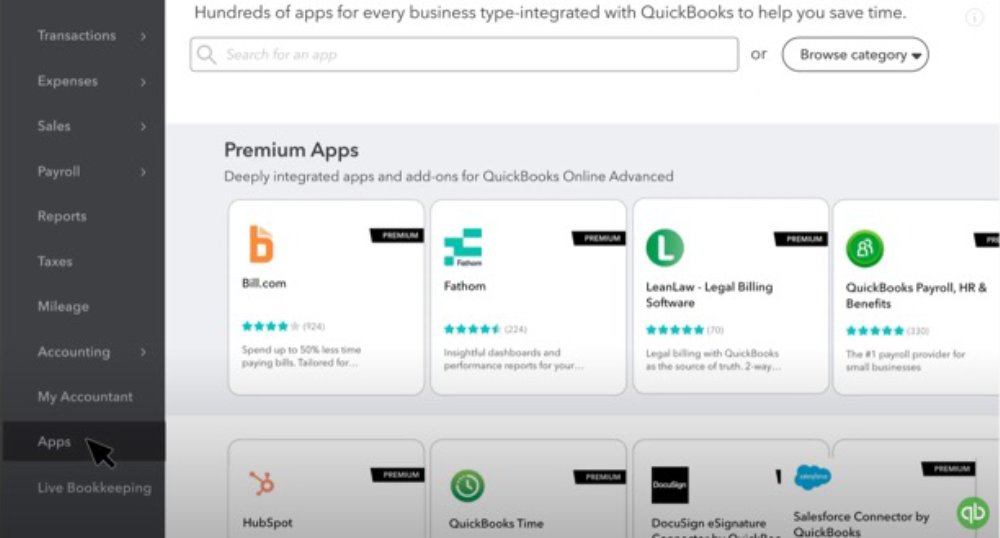

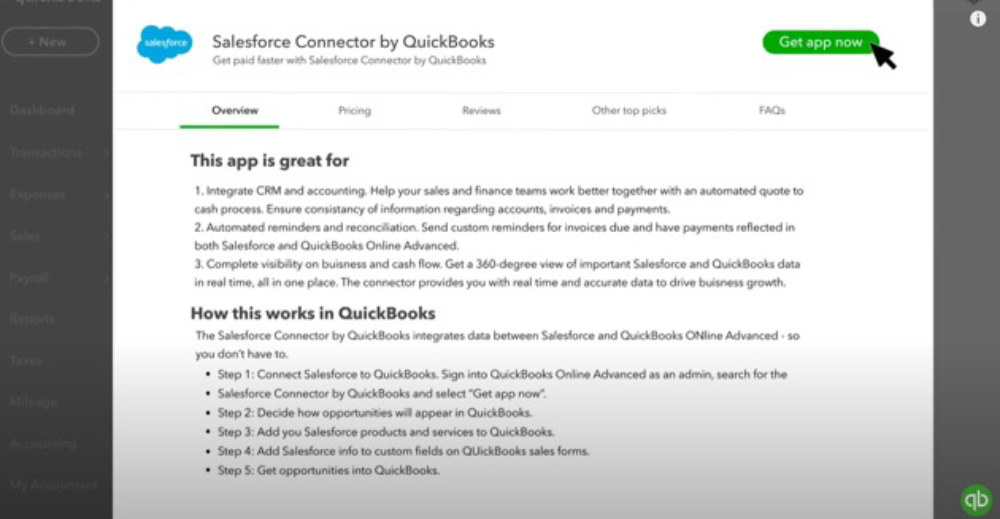

The black column of the interface has several menu bars. From there, click on Apps. In this menu, search for “Salesforce Connector by QuickBooks”. Get app nowThen select. The search can also be done from the Intuit QuickBooks Apps Center, or from the QuickBooks website.

Step 3

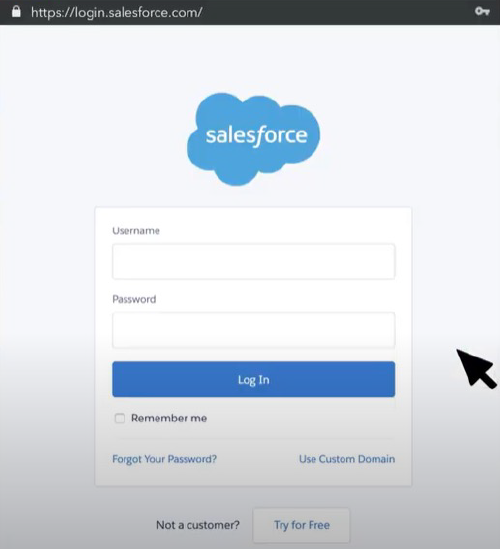

Go to the sign-in option of Salesforce. Enter your account name and credentials, and log in.

Step 4

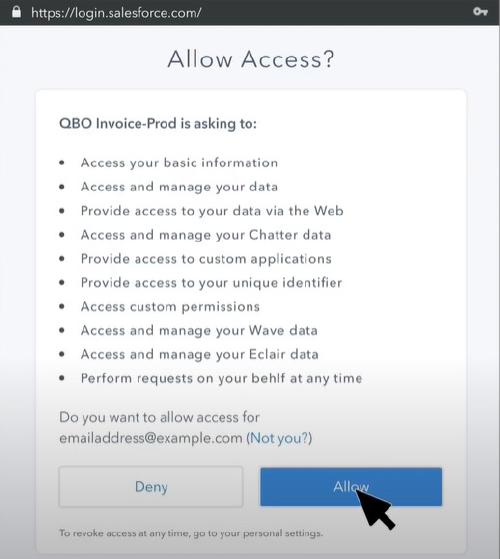

A new window will show up. That will ask you to allow access requests. Click on Allow. After the two platforms connect, you will see a message saying Connection complete.

Step 5

Next, you’ll need to complete more setup tasks. For example, choose what type of opportunities you need to import into QuickBooks.

Step 6

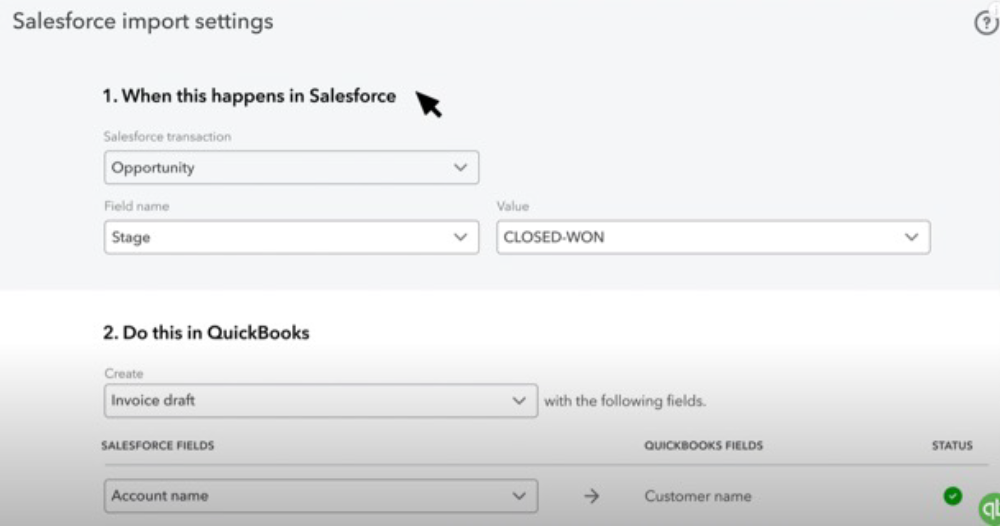

Now you must organize the fields of both QuickBooks and Salesforce, of which you need the common information from Salesforce in QuickBooks. The left side of the screen shows the fields in Salesforce, and the right side is for QuickBooks.

The data you don’t require can be an empty field. At the right side of the bottom of the screen, there is the option Add a custom field in QuickBooks. Click here and set up a custom field the way you want. After filling up the sections, click Save and close.

This setting can be updated at any time from the menu Import settings.

Step 7

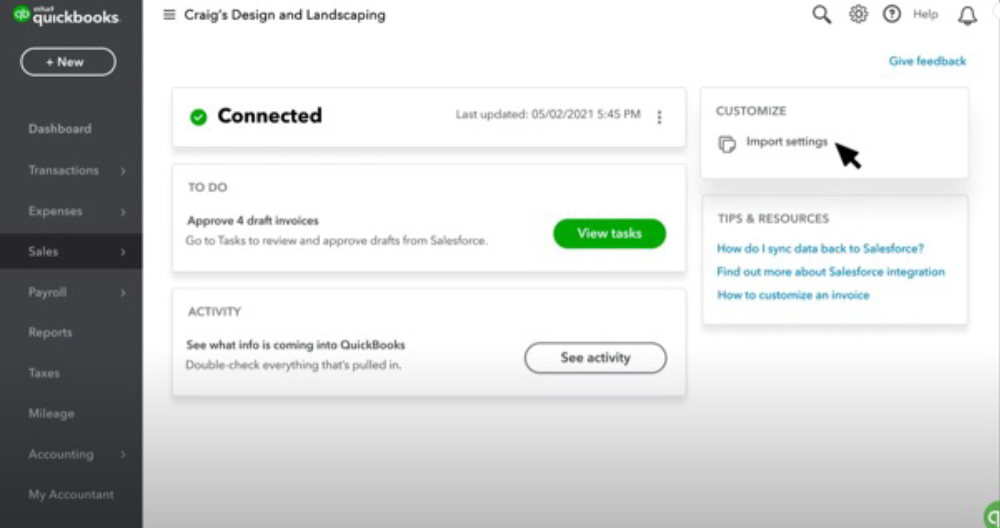

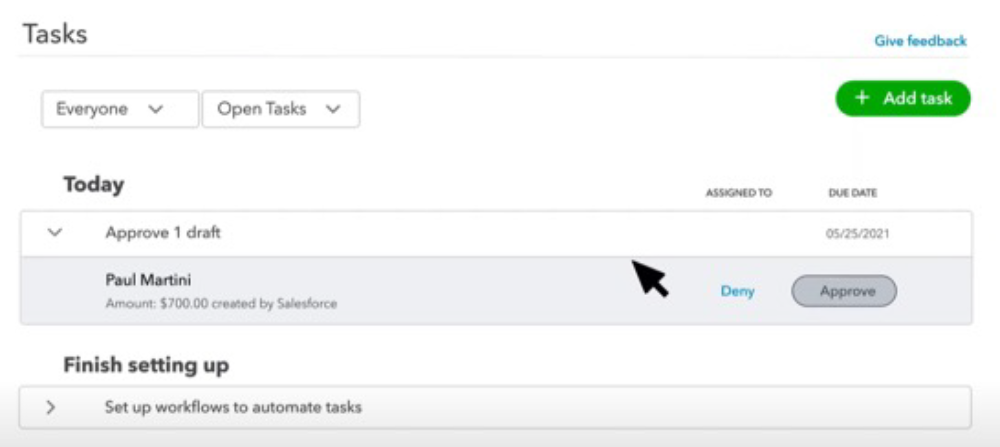

Now QuickBooks has already been downloaded automatically from Salesforce and you are almost done after finishing a few more configuration steps. Click View Task to review and finalize the draft. If everything appears to be okay, click Approve.

A new interface will appear (with the header Invoice (draft)), and you can make a new change in the Description box. Finally, save the invoice as approval from your side.

Now you’ve successfully connected Salesforce and QuickBooks, and you can check to see whether the configuration has been done properly.

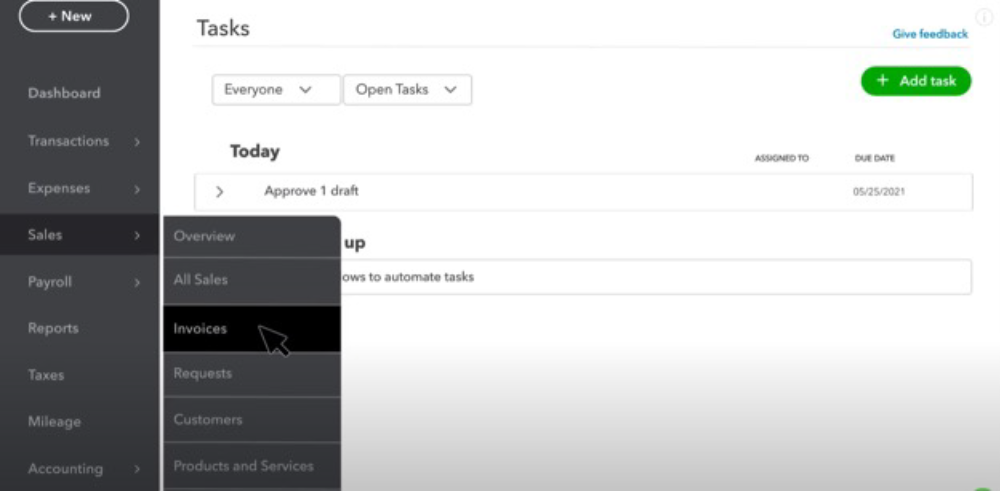

Go to Sales, then Invoices. If the Salesforce QuickBooks integration has happened properly, QuickBooks will have sent the information to Salesforce and any payment updates you’ve made in QuickBooks should appear identically in Salesforce.

Salesforce QuickBooks Integration Tools

There are also several applications available that help integration between Salesforce and QuickBooks. Let’s review some features of three of the most common tools that Salesforce developers can use to integrate the world’s #1 CRM with QuickBooks.

DBSync

- The software applies AR analysis tracking in customer management

- It minimizes duplicate data entries and helps boost productivity

- It doesn’t need expertise in payment-creating to operate

Breadwinner

- It allows multiple currencies

- Operates in real-time

Workato

- Automatic update and sync in the accounting process and customer and invoices

- Easy and effortless integration and data transfer

Final Considerations

Integrating Salesforce and QuickBooks can give your financial and accounting teams as well as your marketing and sales teams better information and actionable insights to make better decisions, win more business and provide better service to customers.

Having QuickBooks integrated with Salesforce gives your team a single source of truth for financial and customer data across the organization and across departments, teams, and locations.

Your teams will become more productive and efficient with automated processes, and have greater confidence in data accuracy. Salesforce QuickBooks integration also helps teams collaborate better and build tighter relationships with customers, vendors, business partners, and each other.

Frequently Asked Questions

Here are some frequently asked questions from business executives and IT leaders that are considering Salesforce QuickBook integration so they can clear up confusion, understand the process better and make a decision.

Does Salesforce Integrate with QuickBooks?

Yes, Salesforce integration with QuickBooks is an easy process that can make both systems more productive and effective. Salesforce and QuickBooks can synchronize and share data back and forth for invoices, orders, payments, estimations, accounts payable, etc. Integrating these two core systems can give senior leadership more insights into their sales pipeline, revenue trends, customer service, marketing campaigns and business operations.

How Do I Link QuickBooks to Salesforce?

Go to the App menu from your QuickBooks interface. Search Salesforce Connector by QuickBooks. A new interface will appear. Click Get app now from the top right of the screen. Follow the steps that come after.

Then select Continue. From the following interface, select a date from when you want the information of Salesforce. Click Agree and there will be auto-synchronization with your Salesforce account.

Make sure that you’re logged in to Salesforce. You also need to be logged in to QuickBooks.

What is the Difference between QuickBooks and Salesforce?

Salesforce is the world’s #1 CRM platform, and it allows companies to communicate more seamlessly with customers, vendors and other business partners.

QuickBooks is the leading accounting and financial software for small and medium-sized businesses, and integrating QuickBooks with Salesforce can help companies use both platforms more effectively and run their business more successfully and efficiently.

While QuickBooks does have some customer interaction functions that Salesforce also has — such as invoices, accounts payable, accounting, cash flow, etc. — it doesn’t have the complete CRM and other data that Salesforce offers.

Does Salesforce Integrate with Accounting Software?

Yes, Salesforce can integrate with QuickBooks accounting software as well as other financial and accounting programs such as FreshBooks, Xero and Wave. FinancialForce Accounting is another cloud accounting software application that may be a good fit.

QuickBooks and most other major accounting software makers offer tools to easily integrate with Salesforce so business can automate more essential processes and become more efficient. A well-structured cloud accounting application with the #1 CRM enables your team to provide the best customer service possible.